Money in the Bank Part 1: How to stop chasing invoices and get paid faster

Have you ever had to chase an unpaid invoice from a client? It can be a frustrating experience and can erode a relationship. Unfortunately, it happens, and it’s all too common for service providers. Why? The business transaction between a service provider and the client is usually not as simple as a product purchase. There are timelines in place, perhaps even deposits. So what do you do when a client invoice is overdue? Read on to discover some strategies for managing this situation and setting yourself up so that you reduce the chances of this unpleasant experience happening again in the future.

Outline the client journey:

One of the best things you can do to stop chasing unpaid invoices is to have a process in place that helps to avoid the situation in the first place. By being proactive at the start of your relationship, you can ensure you will get paid on time. What does being proactive mean in this situation? It means owning the process and taking charge of how you onboard your client.

What does this look like? Set the stage early on in your client relationship by leading with open and clear communication about delivery targets, scope of work, payment terms and payment method right from the beginning. In our experience, there is no such thing as over-communicating when it comes to how you will be working together, so don’t be shy when it comes to sharing necessary info with your clients - everyone will only benefit!

But before you even dive into communication with your clients, take a step back and take a moment to outline a client journey. What is a client journey? Think of it as the roadmap any new clients you onboard will take as they become your customer. In other words, the way your clients will experience working with your business. It is a way for you to map out the systems and communication that will be necessary from the time you onboard, to when you deliver your service, to then getting paid, and the subsequent follow-ups thereafter. Having a streamlined and professional process will make the experience better for you and your client.

Here are some things to consider when setting up these systems:

- Will you take payments upfront or have a deposit structure in place?

- When and how do you begin working with them?

- How will you accept payment?

- How long will they have to pay?

- Will you charge a fee on overdue payments?

- Will there be sales tax on the cost of the service?

- How and when are you invoicing?

- What is the scope of the services you are providing? We mean the exact scope here, you can never be too specific.

- What is your fee for services outside the scope of the current agreement?

All of this information should be included in your contract. Don’t have a contract? You can easily get contracts and customize them to your business at Contracts Market - our trusted resource for customizable legal contract templates.

By anticipating the entire experience from start to completed project, you can get a full picture of what needs to be in place for things to go smoothly. If you are one step ahead of the game, you are less likely to run into issues like unpaid invoices.

Communicate like a pro:

Effective client communication (read management) is an underrated skill in business. It is crucial to a smooth and happy transaction for not only your client, but for you as well. It’s essential to be completely transparent and up-front with your clients. We recommend you set aside time with the client to define deliverables and deadlines. Openly speak about what might happen if you get into scope creep, so that they are not surprised if you bring it up in the future. Making sure that you have a good contract in place is critical here. The contract should outline the scope, payment terms, and all the details associated with your service.

We are always surprised to see how many people go on ‘good faith’ and skip the contract altogether. Not having a contract in place only opens you up to not getting paid and sets the tone for your client. They will not treat you professionally if you don’t treat yourself as a pro. You are setting the foundation for a happy and mutually beneficial client relationship by being crystal clear.

Do what you said you would do:

This is where a bit of tough love comes in. If you are constantly late with your deliverables, if your communication is last-minute or messy, you are setting yourself up for the same. You can’t expect your clients to pay you on time if you don’t deliver on time. Holding yourself accountable as a service provider is one of the hardest things to do.

Are you enforcing your contract? If you regularly go out of scope, or your client is late in scheduled handovers, and you have addressed this in your agreement, be prepared to enforce it. If you don’t think you will and would instead manage it on a case-by-case basis, then leave it out of the contract. A contract can quickly lose its power if you, as the provider, are not following the rules.

How’s your follow-up game? We recommend you set yourself up for success by having a ready-to-go email template for client follow-ups. You don’t have to reinvent the wheel every time that payment deadline rolls around (and passes). Set a trigger a day after a late payment and strike while the iron is hot. If you can time that email for the early part of the week (Monday, Tuesday), you have a better chance of getting your client to act on it.

The Bottom Line:

Clear client communication will eliminate a lot of your unpaid invoice woes. Of course, there will always be that one client that is consistently late; frankly, that’s not something you can change. You are better off looking for a new client who is respectful of your service.

The good news is that a massive amount of this is still in your hands. You will keep that bank account buzzing with proper planning and clear communication.

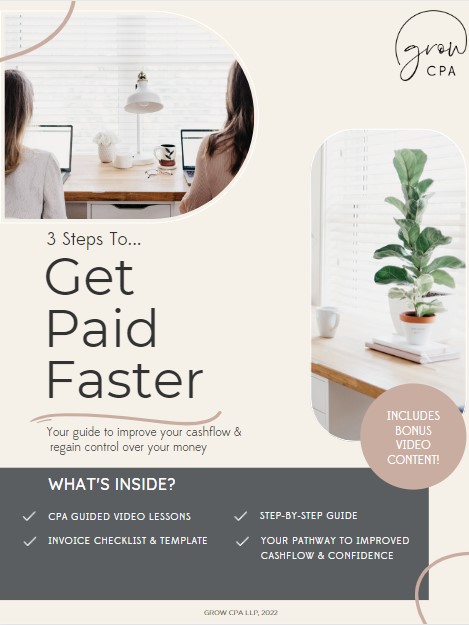

Want more tips on how to get paid faster? Check out our FREE resource: 3 Steps To Get Paid Faster. This free guide will help you improve your receivables turnaround time, leading to improved cashflow, better communication with your customers, and overall greater confidence for you in managing your money.

Stay tuned for part 2 of this series later this month!

Interested in learning more from us? Follow along with us through our social media accounts (find us on Instagram @growcpa) and sign up for our newsletter for more educational and fun financial content.

Wishing you success in your business,

- Martina + Ashli

Date published: August 4, 2022

Disclaimer - The information provided in this blog is general in nature and solely for educational purposes. Readers use and implementation of the information comes at their own risk and is their own responsibility.